Take advantage until 31 March 2025

Help to Buy Scheme Wales

If you want a buy a new home but are struggling to save a big deposit, the extended Help to Buy Equity Loan Wales can make that move easier. The popular scheme has already helped thousands of Keepmoat customers buy a new home with just a 5% deposit and more affordable monthly mortgage payments. The Welsh Government has extended this scheme until 31 March 2025 to help even more buy a home in Wales.

How does Help to Buy Wales work?

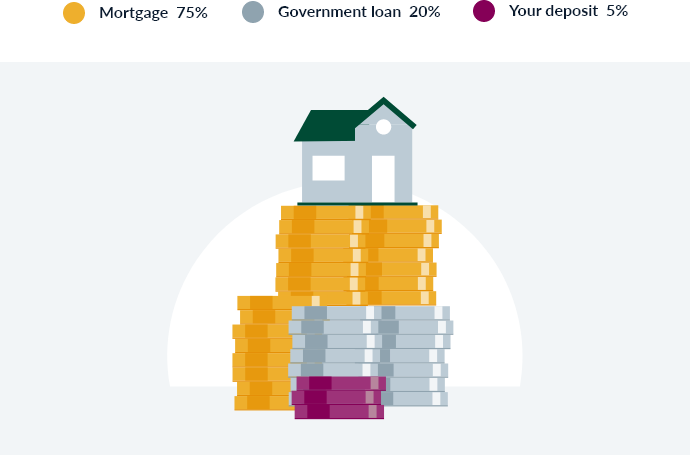

With the Help to Buy Wales scheme, you receive a Government-backed equity loan of up to 20% of the cost of your newly built home. This means you can buy your home with as little as a 5% deposit, with the remaining 75% covered by your mortgage.

Help to Buy makes buying a home in Wales much more achievable.

- You only need a 5% minimum deposit for your new home

- Your Help to Buy Equity Loan can cover up to 20% of the value of your new home

- Up to 75% of the remaining costs are covered by your mortgage

- The Help to Buy Equity Loan is interest-free for up to 5 years

- Once you’ve secured your new home, your equity loan can be repaid over 25 years

What is a Help to Buy Equity Loan?

A Help to Buy Equity Loan is a Welsh Government loan scheme. You can borrow up to 20% of the property purchase price, interest-free for up to five years. The equity loan, combined with your minimum 5% deposit means you’ll need a smaller mortgage with more affordable monthly repayments.

Who is eligible for Help to Buy?

To qualify for the Help to Buy Wales Scheme, you must be:

- Buying an eligible home, with a maximum price of £300,000 from a homebuilder who is registered with the scheme, such as Keepmoat.

- Be able to fund at least 80% of the property price through a combination of a repayment mortgage and a minimum deposit of 5% of the purchase price

- Able to take out a first-charge repayment mortgage with a qualifying lender

- You must not sub-let any part of the house you are buying through the scheme

- You cannot rent your existing home and buy a second home through the scheme

Help to Buy Scheme: Pros and Cons

Pros of Help to Buy

If you want to buy a new home but are struggling with your deposit, the Help to Buy scheme could make a big difference in getting you on the property ladder.

- You can buy a home with a 5% deposit - While you still need a deposit to purchase a home through Help to Buy, this is set at a much lower rate. You could be moving into your new home with as little as a 5% deposit, which is lower than most other mortgage options out there.

- Your equity loan is interest-free for five years - The Help to Buy Equity Loan you receive from the Government carries no interest for the first five years. Often, this period is the most expensive for homeowners, as additional purchases and home decoration costs can quickly add up. This five-year interest-free period helps lift some of the strain.

- You could enjoy more affordable overall mortgage rates - As you are borrowing less money overall, the likelihood of qualifying for your mortgage is higher and you are likely to enjoy much more competitive interest rates.

Limitations of Help to Buy

- While Help to Buy can help you step onto the property ladder, loans always come with certain limitations that you should consider when moving forwards with the scheme.

- After five years, your loan will become increasingly expensive - If you take out an equity loan as part of the Help to Buy scheme, this is interest-free for up to five years. However, once these five years are up, you’ll be charged 1.75% on the outstanding amount as interest. This fee will increase each year by RPI plus 1%.

- Your loan repayment is not fixed - As your Help to Buy Equity Loan is based on percentages, it is not a fixed price loan. This means when you come to sell or pay back the loan it can increase or decrease as the market value of your home changes. So, if you received a loan for 20% of the value when you bought the home, you’ll have to pay back 20% of the value when you sell meaning if your home has increased in value, you’ll have to pay back a little more than you borrowed.

- If you’ve already paid back your equity loan, there’s nothing else to pay back to the scheme.

Help to Buy Wales FAQ's

What is an Equity Loan?

An equity loan is money lent in order to secure a property.

The term ‘equity’ is simply referring to the difference between the cost of your home and the amount you pay for it yourself. In the UK, an equity loan is money that you borrow in order to top up the amount you put into a new home. You save an initial deposit, with the equity loan making up the remaining amount.

In Wales, the equity loan is managed by the Government and Homes & Communities Agency, and is offered as an alternative route onto the property ladder for those who may otherwise be unable to put down a full deposit on a property.

Can you pay back your equity loan early?

While you can use the full five years to pay back your Help to Buy Equity Loan interest-free, you can also choose at any time to make additional part or full repayments. If you choose to make a voluntary repayment, this must be 10% of your home’s current market value. Every time you want to make a repayment, an independent valuer must assess your property.

Can you put down more than a 5% deposit?

Yes. The Help to Buy 5% deposit is the minimum percentage you can put down, but you can always choose to put down a higher deposit if this works for you. Putting down more than 5% deposit will mean taking out a mortgage at less than 75%. In these instances, it’s always worth speaking to your financial or mortgage advisor to see what will work the best for you and your circumstances.

What if you want to remortgage your home?

It is possible to remortgage your Help to Buy home – you simply remortgage the standard mortgage that you took out at the same time as the equity loan. You will then either need to keep the Help to Buy Equity Loan and continue paying (with accrued interest after five years) or repay the loan. In these cases, you can also usually expect to pay admin fees.

What happens if I sell my Help to Buy home?

When you sell your Help to Buy home you will repay your equity loan at the same time. So, if you initially purchased with a 75% mortgage and a 5% cash deposit and have made no other repayments you will repay 20% of the value of your home at the time you sell. An independent valuer will decide what your home is worth and your home needs to be sold on the open market.

More ways to buy your new home

Easymove

If you want to move to a new Keepmoat home but still have a property to sell, we can help.

Shared Ownership

The shared ownership scheme lowers the cost of buying a new property.

Deposit Unlock

A new way to move - without needing a big deposit.

Terms and conditions

Help to Buy: Equity Loan scheme (2021-2023) is available on selected plots and developments only, subject to terms and conditions and cannot be used with any other offer. Help to Buy purchasers are required to fund at least 80% of the purchase price by means of a conventional mortgage, savings and any deposit where required. Eligible applicants will be offered an equity loan of up to 20% of the market price, interest free for the first five years. At the start of year six a fee of 1.75% is payable on the equity loan, which rises annually by RPI inflation plus 1%. The equity loan is held as a second charge on the property. Terms and conditions apply and full details will be provided on request. Please note Help to Buy charge £1 a month from outset as a management charge.