Investors

Get the inside track on Keepmoat and our financial performance

A Resilient and Agile Business

Keepmoat has delivered a strong financial performance in the financial year to 31 October 2023. The business has once again performed well delivering a record number of new homes and a strong financial result against the backdrop of economic uncertainty which characterised much of the year. Keepmoat's unique Partnership Business Model, underpinned by the multi-tenure offering and the attractiveness of the product, has once again proved its value, demonstrating that it allows the business to operate successfully and thrive in all market conditions.

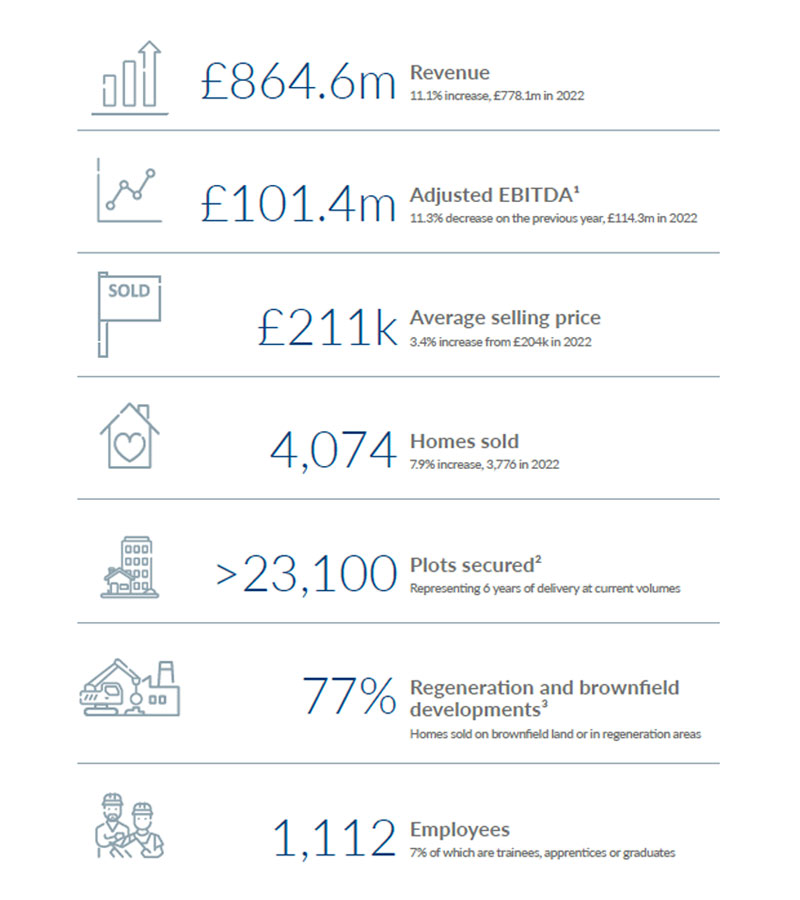

2023: at a glance

The 2023 financial year saw Keepmoat deliver a strong financial performance, proving itself to be a resilient and agile business and unlike many of its peer group, has continued to grow, maintaining volumes, continuing to invest in land and delivering a record number of new homes where others have had to slow production.

Evolved for growth

Each of the regional businesses has its own management board and is empowered to deliver our overarching operational excellence strategy, applying the Group’s policies and systems to local markets and circumstances. This agile structure and approach mean we are well positioned for future growth.

Nine regional businesses, organised into three divisions:

- North West, Yorkshire West and MCI developments

- Scotland, North East, and Yorkshire East

- West Midlands, East Midlands and South Midlands

A business built on strong foundations

Keepmoat have continued to make careful investment in it’s operational capability and in land pipeline, where opportunities are fully aligned to our partnership multi-tenure business model.

Strong operational performance, financial position, resilient business model and focussed investment positions the business well against an uncertain economic backdrop to deliver continued controlled growth over the medium term.

Annual Report 2023

Read our latest Annual Report, which details Keepmoat’s performance and achievements during 2023.

Download our previous annual reports

- View our 2022 annual report and financial statements for the year ended 31 October 2022.

- View our 2021 annual report and financial statements for the year ended 31 October 2021.

- View our 2020 annual report and financial statements for the year ended 31 October 2020.

- View our 2019 annual report and financial statements for the year ended 31 October 2019.

- View our 2018 annual report and financial statements for the 7-month period ended 31 October 2018.

- View our 2018 annual report and financial statements for the year ended 31st March 2018.

- View our 2017 annual report and financial statements for the year ended 31st March 2017.

Keepmoat considers its annual reports to be compliant with the Walker Guidelines. In relation to disclosures on human rights, please refer to Keepmoat's Modern Slavery Act compliance statement.

Tax strategy

We have structured our systems, processes and controls to ensure that tax liabilities are calculated accurately, and that tax is paid on time

Minimising risk. Maximising compliance

We have structured our systems, processes and controls to ensure that tax liabilities are calculated accurately, and that tax is paid on time. We additionally employ designated internal resource to monitor the effectiveness of our systems, processes and controls, to ensure they remain appropriate as the group evolves.

24th January 2024

This document sets out the Group’s approach to conducting its tax affairs and dealing with tax risks for the year ending 31 October 2024. This document complies with Schedule 19 of Finance Act 2016 in relation to groups publishing their tax strategy.

Approach to risk management and tax governance arrangements

Keepmoat has structured its systems, processes and controls to ensure that tax liabilities are calculated accurately, and that tax is paid on time. Keepmoat employs designated internal resource to monitor the effectiveness of its systems, processes and controls to ensure that they remain appropriate as the group evolves. Keepmoat recognises that monitoring systems is particularly important in times of business growth, change or expansion.

Tax compliance is a key priority for the Group’s Board of Directors. The Board commits to considering the appropriateness of the Group’s tax processes and controls at least annually (and more frequently should the need arise). The Board has approved this Tax Strategy. In particular, Keepmoat has measures in place to manage the following:

Corporate change

Whilst the Keepmoat business is long established, its corporate structure is dynamic. Keepmoat recognises that corporate activity, such as share sales, mergers, acquisitions, and refinancing activities require adaptability and integration. Keepmoat involves external tax specialist resource to support its corporate finance activity. In addition, Keepmoat designates its own internal resource to ensure that change as a result of corporate finance activity is fully embedded within its business operations.

Areas of judgement

Unfamiliar areas of tax law, or areas of the law that require interpretation or judgement present uncertainty. Where appropriate, Keepmoat uses external specialist resource to assist with its compliance decisions. Keepmoat also actively seeks review and clearance from HMRC where possible.

Inherent risk

The nature of Keepmoat’s site-based activity across developments is fairly consistent. However, projects may vary in terms of structure, scale, value and term. Our operations require us to employ a mobile workforce and subcontractor base. Tax specialist review is undertaken where new ventures are unusual or innovative, involving the use of external experts in areas of uncertainty.

In the event that Keepmoat identifies an error in its tax affairs, we commit to communicating promptly to HMRC with a view to resolution.

Attitude towards tax planning

When considering entering into any new business agreements, Keepmoat takes into account the impact the arrangements could have on its brand and reputation, its relationships with customers and supply chain, its commitment to corporate social responsibility and the legal and regulatory frameworks. Keepmoat avoids undertaking arrangements that are purely or mainly motivated by a tax saving.

Keepmoat commits to seeking external tax advice in the following circumstances:

- Areas of law that are new, changing or complex

- Where tax is impacted by the expansion into new areas of business

- Corporate finance related transactions

Level of risk that the Group is prepared to accept

Keepmoat takes a responsible, conservative attitude to tax risk. Transactions with a tax impact are only undertaken with a commercial goal in mind; they are not undertaken purely for a tax incentive. The Group’s shareholders are supportive of Keepmoat’s focus on corporate social responsibility.

Approach of the Group to its dealings with HMRC

Keepmoat commits to maintaining a good working relationship with HMRC. Keepmoat uses its Customer Compliance Manager as its primary contact. Keepmoat commits to communicating with HMRC in a courteous and timely manner. Keepmoat wishes to be open, honest and transparent in its dealings with HMRC. Prevention of unnecessary dispute is preferred, and Keepmoat will work with HMRC on a real-time basis as far as possible.

Quarterly results calls

2024 Calendar:

- Results Presentation for our FY23 Annual Report and Financial Statements – 27th February 2024

- Results Presentation for our FY24 Q1 – 26th March 2024

- Results Presentation for our FY24 Q2 – 25th June 2024

- Results Presentation for our FY24 Q3 – 24th September 2024

To register for the Quarterly Result calls, please complete the registration form below. Dial in details will be sent to the email address provided by you.

The results for each quarter will be published at 7am on the day of the investor call.

Please note, if at any time you have opted to be included on our distribution list, all dial in details and publications will be automatically issued to you.

For more information on the personal data we collect and what we might do with it, see our privacy notice.

Register:

To register for the Quarterly Result calls, please complete the registration form below. Dial in details will be sent to the email address provided by you.

Sustainability

At Keepmoat we think and act beyond bricks and mortar – sustainability is built into our very vision: Building Communities and Transforming Lives.

As well as creating better places for people to live, we know our success depends on playing our part in building the sustainable communities and enhanced environments our customers and partners value.

Our priorities

With Building Communities and Transforming Lives at the forefront, we are focused on the issues of most importance to the people around us, where our business can make the greatest contribution.

Building Communities, Transforming Lives - Alongside creating better places for people to live, we work with our partners to create and improve places and in turn improve economic, environmental and social outcomes. In 2020: £18.3m social value delivered

KeepWell - Supporting the health and wellbeing of our staff, our sub-contractors and our communities. In 2020: 14,704 COVID-19 site inductions

Climate Action - Taking action to reduce absolute carbon emissions from our operations, our supply chain and the homes we build, and to adapt our operations and homes to our changing climate. In 2020: 93% electricity on renewable tariffs (now 100%)

Net Positive - Protecting and enhancing our environment across the lifecycle of our operations, homes and our developments. In 2020: -11% environmental incidents

Educating for construction - Providing education and development opportunities for our staff and communities to address the construction sector skills shortage. In 2020: 45 construction apprentices

Safe and sustainable operations - Assuring the safety and sustainability of our sites, operations and supply chains, and increasing the proportion of people from local communities in our workforce. In 2020: 6% reduction in lost time injuries

Sustainable Homes - To deliver increasingly sustainable homes (affordable, efficient, low carbon and adaptable). In 2020: 3,000 tonnes carbon avoided over life of homes constructed

Efficient operations & Zero Net Waste - Achieve zero net waste construction through waste minimisation and buying recycled. Continually improve our management systems (ISO 14001, ISO 9001 & OSHAS 18001). In 2020: 33% reduction in total waste

How we prioritise

We determine our priority sustainability issues, not just through internal discussion, but through reaching out to charities and community groups, our suppliers, local government and development partners, and our investors.

A major engagement activity was held in 2019 to assess the most important or ‘most material’ issues to focus on, involving 135 internal and external stakeholders, consisting of quantitative and qualitative research. Regular stakeholder engagement is an ongoing process, and we will be working with partners to review our targets, and gaining more customer views on sustainability in our 2021 financial year.

While the value we create through our developments begins at the local level, these activities can contribute to regional, national and global goals. We have aligned our focus and objectives to eight of the United Nations’ Sustainable Development Goals where we can make the greatest contribution.

Governance and management

The Board and Executive have overall oversight of the sustainability strategy (see Sustainability Strategy 2020-2022), providing directional steer and approving the release of the right resources for sustainability to be effectively managed. The Board and Executive approve sustainability policy, strategy and commitments.

The HSS Committee, headed by the Health, Safety and Sustainability Director plays a co-ordinating role, developing the sustainability strategy. Under this sits the Sustainability Team responsible for coordination of the strategy. It provides tools and initiatives for functions and monitors and reports on performance.

Ultimately, delivery of the sustainability strategy happens though functional and regional teams through all operational activities. A team of Social and Economic Impact Managers delivers sustainability initiatives at the community level.

Reflecting the wide-reaching implications of sustainability for our business, and the recommendations of the Taskforce for Climate-related Financial Disclosures the business is currently reviewing it’s Environmental, Social and Economic Governance, with outcomes to be reported in due course.

Climate risks and opportunities

The physical impacts of climate change, and global efforts to mitigate it have implications for all businesses and society as a whole. Our Sustainability Policy and Environmental Policy contains a clear commitment for our business to mitigate and adapt to climate change.

In our 2021 Financial Year, we are reviewing our risks and opportunities in line with the recommendations of the Taskforce for Climate Related Financial Disclosures (TCFD) and will be publishing our first CDP Climate Survey in 2022, providing further detail on initial risks and opportunities identified.

Policies and publications

- Environmental policy

- Sustainability policy

- Quality policy

- Health and Safety policy

- Sustainable Procurement policy

Other publications